Nyt Sparks Backlash After Inane Op-ed By Unitedhealth Group Ceo

Critics are torching a New York Times op-ed Friday by the chief of UnitedHealthcare’s parent company, arguing that the $23.5 million-salaried executive’s message overwhelmingly ignored the failures actively perpetuated by his company in the American health care system.

UnitedHealth Group CEO Andrew Witty condemned the American public’s gleeful response to the death of UnitedHealthcare CEO Brian Thompson, who was assassinated by a masked gunman last week on the streets of New York City just hours before an investor meeting.

In roughly 600 words, he also attempted to deflect his insurance network’s responsibility in the growing inequity in America’s health care system, vaguely pointing to a “patchwork” of failures decades in the making while swearing that his corporate network—which reported $22 billion in profits in 2023 alone, nearly three times the figure reported by CVS, the second-most-profitable health insurance company that year—was consistently fighting to “deliver high-quality care and lower costs.”

But readers weren’t buying it.

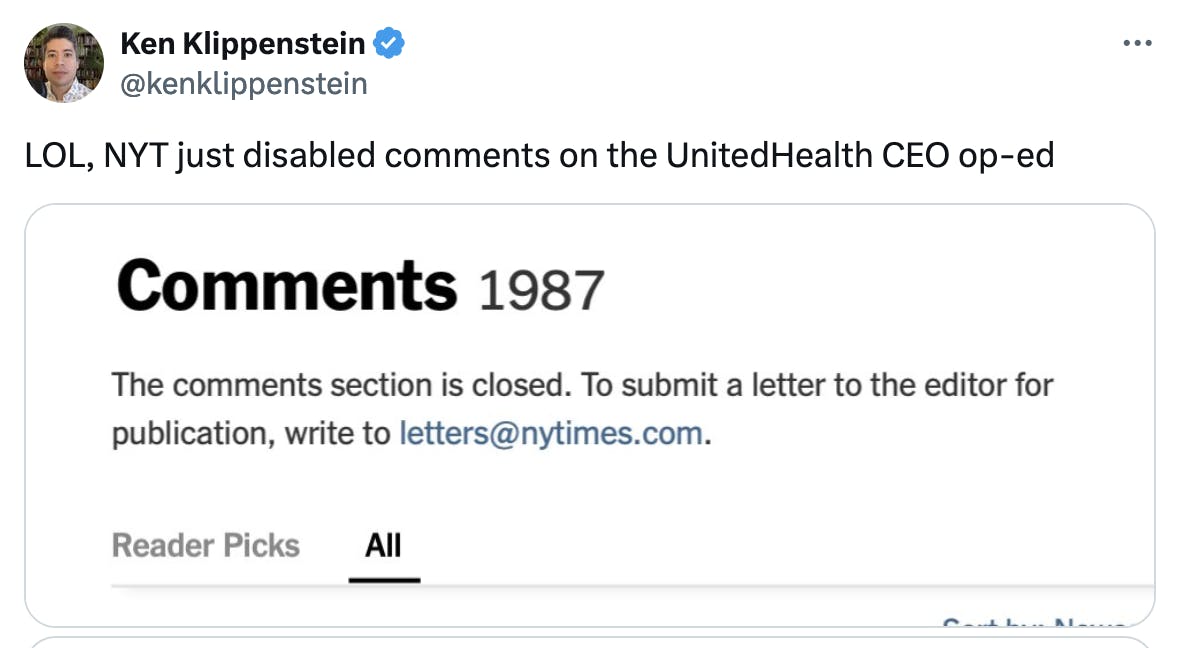

Instead, they swarmed the Times with negative feedback, piling on more than 2,500 comments within hours of the article’s publication, temporarily disabling its Comments section. Users shared their own horrible experiences with the health insurance industry, deriding Witty’s vapid analysis as a “self-serving essay” that did nothing to address UnitedHealthcare’s role in a system that prioritizes shareholder profits over successful medical outcomes for its clients.

Federal data from 2022 compiled by the personal finance website ValuePenguin found that UnitedHealthcare far outpaced its competitors when it came to denying coverage, rejecting 32 percent or roughly one in three claims. In 2024, the insurer’s parent group spent more than $5.8 million lobbying Congress on health care–related issues.

Meanwhile, Americans are paying more than ever for health insurance, with costs far outpacing the rate of inflation. A Kaiser Family Foundation report published earlier this year found that the vast majority of U.S. adults are worried about being able to afford a major medical expense, regardless of their financial position.